Loanable Funds Model Graph

Loanable Funds Model Graph. To watch the loanable funds practice video please go to the ultimate. In a few words, this market is a simplified view of the financial system. According to this approach, the interest rate is determined by the demand for and supply of loanable funds. Lecture over the loanable funds market, a key graph and concept for the ap macroeconomics class and test. The market for loanable funds.

Drag the yellow rectangles to move the lines on the graphs. 2019 ap macroeconomics (set 1). 50 loanable funds market at the equilibrium real interest rate, the amount borrowers want to borrow equals the amount lenders want to lend savings = investment real interest rate s (savings) re d(investment) qloans quantity of loans 50. We will simplify our model of the role that the interest rate plays in the demand for capital by ignoring differences in actual interest rates that specific consumers and. In this video heimler explains the money market, including the liquidity preference model and the loanable funds model.

B) assume the nominal interest rate is currently at 8% and there is no expected inflation.

Consumers it makes the purchases of houses, cars, big screen t.v powerpoint presentation : All savers come to the market for loanable funds to deposit their savings. Let's say that the government decides to increase. The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits. Commercial banks and lending institutions that. All lenders and borrowers of loanable funds are participants in the loanable. To watch the loanable funds practice video please go to the ultimate. Loanable funds market supply of loanable funds loanable funds come from three places 1. The crowding out effect occurs when a government runs a budget deficit (it spends more money than it collects), causing the real interest rate to increase, and private. Loanable funds represents the money in. Learn vocabulary, terms and more with flashcards, games and other study tools. Real interest rate quantity of loanable funds r* qlf* demand for loanable funds* (consumers/businesses) supply. The equilibrium interest rate is determined in the loanable funds market.

Use chrome or safari to move or draw graphs with your finger. Drag the yellow rectangles to move the lines on the graphs. Draw primary lessons from the use of the. The private sector loanable funds market.

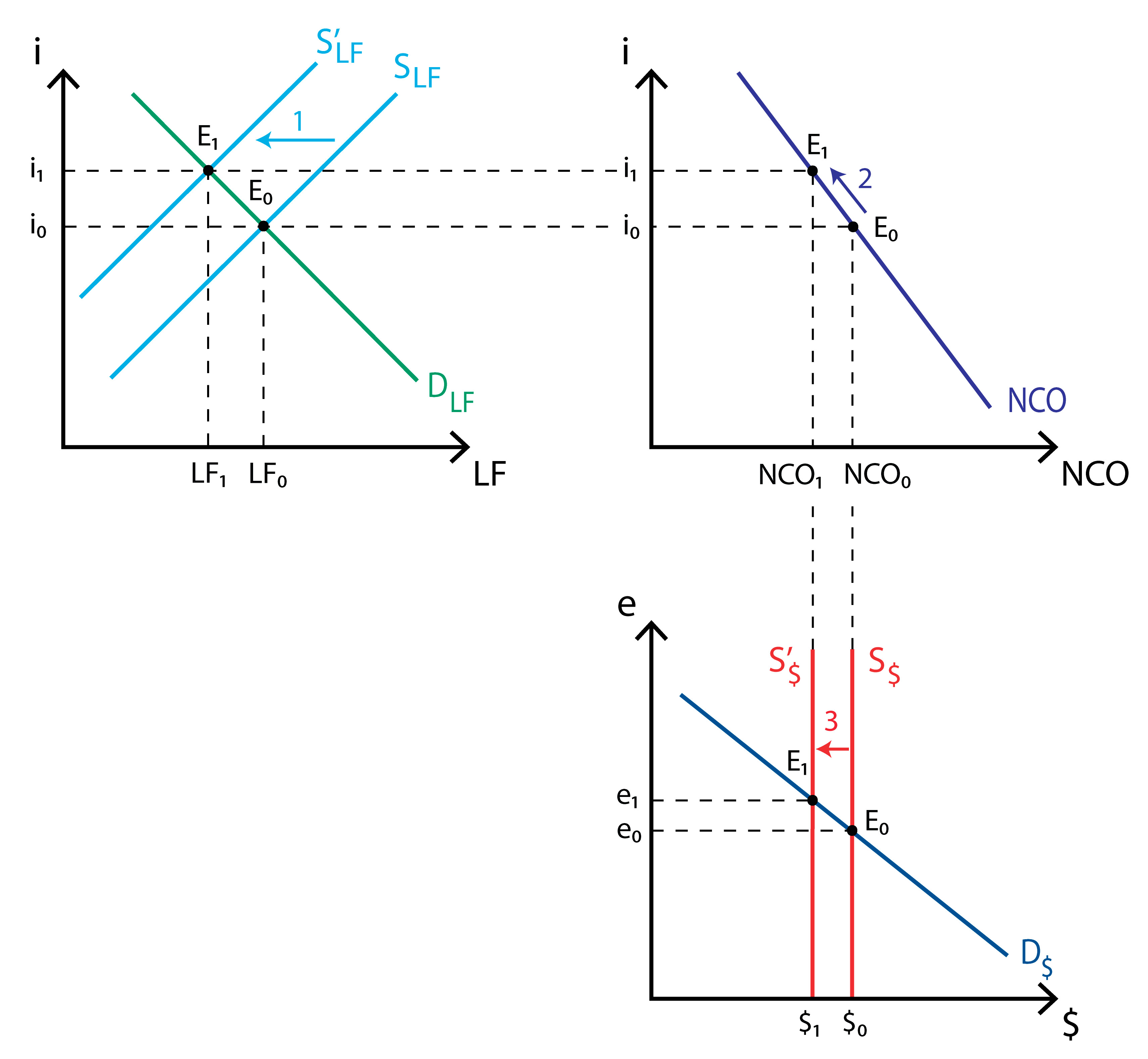

(b.) based on the rir change in (a) what will happen to econoland's purchase of foreign assets?

The suppliers of loanable funds are. (b.) based on the rir change in (a) what will happen to econoland's purchase of foreign assets? According to this approach, the interest rate is determined by the demand for and supply of loanable funds. International borrowing supply of loanable funds curve i 6% 4% 40 60 lf equilibrium in the loanable funds market shifts in demand for. Real returns on savings and real price of borrowing with the public's willingness. As with any simplified economic model the purpose is to be able to predict the other economic response to you move one item on the graph and see what happens to the other items, where is the new teaching loanable funds vs liquidity preference. Loanable funds market •nominal v. The term loanable funds is used to describe funds that are available for borrowing. Draw a loanable funds graph to illustrate this. Perhaps the most common shift of the loanable funds market is the crowding out effect. The private sector loanable funds market. All savers come to the market for loanable funds to deposit their savings. In this one i draw and explain the graph for loanable funds and crowding out. Also, everyone looking for a loan (either to spend it or to invest it) comes to this market. Let's say that the government decides to increase.

We will simplify our model of the role that the interest rate plays in the demand for capital by ignoring differences in actual interest rates that specific consumers and. This includes households, firms, governments and foreign investors. International borrowing supply of loanable funds curve i 6% 4% 40 60 lf equilibrium in the loanable funds market shifts in demand for. B) assume the nominal interest rate is currently at 8% and there is no expected inflation. Drag the yellow rectangles to move the lines on the graphs. Consumers it makes the purchases of houses, cars, big screen t.v powerpoint presentation : The production possibilities curve model.

Ap macroeconomics released 2009 question.

Drag the yellow rectangles to move the lines on the graphs. As with any simplified economic model the purpose is to be able to predict the other economic response to you move one item on the graph and see what happens to the other items, where is the new teaching loanable funds vs liquidity preference. According to this approach, the interest rate is determined by the demand for and supply of loanable funds. In economics, the loanable funds doctrine is a theory of the market interest rate. Draw a loanable funds graph to illustrate this. Describe key interest rates 3. Dont panic , printable and downloadable free the loanable funds theory of interest economics we have created for you. (a.) use a graph of the loanable funds market, showing an increase in savings will affect the real interest rate. Every graph used in ap macroeconomics. Every graph used in ap macroeconomics. Use chrome or safari to move or draw graphs with your finger. A local car merchant may advertise one percent car loans.

All savers come to the market for loanable funds to deposit their savings loanable funds model. Every graph used in ap macroeconomics.

Source: econ101help.com

Source: econ101help.com B) assume the nominal interest rate is currently at 8% and there is no expected inflation.

Source: d2vlcm61l7u1fs.cloudfront.net

Source: d2vlcm61l7u1fs.cloudfront.net Every graph used in ap macroeconomics.

Consumers it makes the purchases of houses, cars, big screen t.v powerpoint presentation :

Commercial banks and lending institutions that.

Any economic actor that puts their money in banks.

Source: www.economicsdiscussion.net

Source: www.economicsdiscussion.net Every graph used in ap macroeconomics.

Source: media.cheggcdn.com

Source: media.cheggcdn.com The graph below is a supply and demand graph, where four percent is the equilibrium real interest rate.

Source: quizlet.com

Source: quizlet.com The equilibrium interest rate is determined in the loanable funds market.

Lecture over the loanable funds market, a key graph and concept for the ap macroeconomics class and test.

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com Describes the loanable funds graph and how it is measured by the real interest rate.

Loanable funds consist of household savings and/or bank loans.

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com Let's say that the government decides to increase.

Source: crimfi.files.wordpress.com

Source: crimfi.files.wordpress.com Perhaps the most common shift of the loanable funds market is the crowding out effect.

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com The crowding out effect occurs when a government runs a budget deficit (it spends more money than it collects), causing the real interest rate to increase, and private.

Source: i1.wp.com

Source: i1.wp.com The loanable funds market therefore recognizes the relationships between.

In addition, this model assumes that prices are not changing during the analysis, so the real interest rate, rather than the nominal interest rate, is used for this market.

Source: d2vlcm61l7u1fs.cloudfront.net

Source: d2vlcm61l7u1fs.cloudfront.net B) assume the nominal interest rate is currently at 8% and there is no expected inflation.

Source: i2.wp.com

Source: i2.wp.com You want to get this right so you can stay here.

Source: apbabbitt.files.wordpress.com

Source: apbabbitt.files.wordpress.com The market for loanable funds.

Source: i.ytimg.com

Source: i.ytimg.com Use chrome or safari to move or draw graphs with your finger.

Source: images.slideplayer.com

Source: images.slideplayer.com Assume that as a result of increased political instability, investors (b) using a correctly labeled graph of the loanable funds market in tara, show the impact of this decision by investors on the real interest rate in tara.

Below you will find 5 questions with explanations to help you quickly review how to draw and manipulate the loanable funds market graph.

Source: welkerswikinomics.com

Source: welkerswikinomics.com International borrowing supply of loanable funds curve i 6% 4% 40 60 lf equilibrium in the loanable funds market shifts in demand for.

Source: www.opentextbooks.org.hk

Source: www.opentextbooks.org.hk B) assume the nominal interest rate is currently at 8% and there is no expected inflation.

Source: 14yagnvi.files.wordpress.com

Source: 14yagnvi.files.wordpress.com (b.) based on the rir change in (a) what will happen to econoland's purchase of foreign assets?

Use chrome or safari to move or draw graphs with your finger.

Source: kokminglee.125mb.com

Source: kokminglee.125mb.com The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits.

Source: files.transtutors.com

Source: files.transtutors.com Commercial banks and lending institutions that.

Source: i0.wp.com

Source: i0.wp.com In this video heimler explains the money market, including the liquidity preference model and the loanable funds model.

Source: welkerswikinomics.com

Source: welkerswikinomics.com As with any simplified economic model the purpose is to be able to predict the other economic response to you move one item on the graph and see what happens to the other items, where is the new teaching loanable funds vs liquidity preference.

Source: apbabbitt.files.wordpress.com

Source: apbabbitt.files.wordpress.com Commercial banks and lending institutions that.

Source: slidetodoc.com

Source: slidetodoc.com Describes the loanable funds graph and how it is measured by the real interest rate.

Source: www.cliffsnotes.com

Source: www.cliffsnotes.com International borrowing supply of loanable funds curve i 6% 4% 40 60 lf equilibrium in the loanable funds market shifts in demand for.

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits.

Posting Komentar untuk "Loanable Funds Model Graph"